Retirement Planning Canada for Dummies

Wiki Article

Excitement About Retirement Planning Canada

Table of ContentsEverything about Financial Advisor Victoria BcThe Definitive Guide to Lighthouse Wealth ManagementInvestment Representative - The FactsAll about Ia Wealth ManagementA Biased View of Financial Advisor Victoria BcRumored Buzz on Retirement Planning Canada

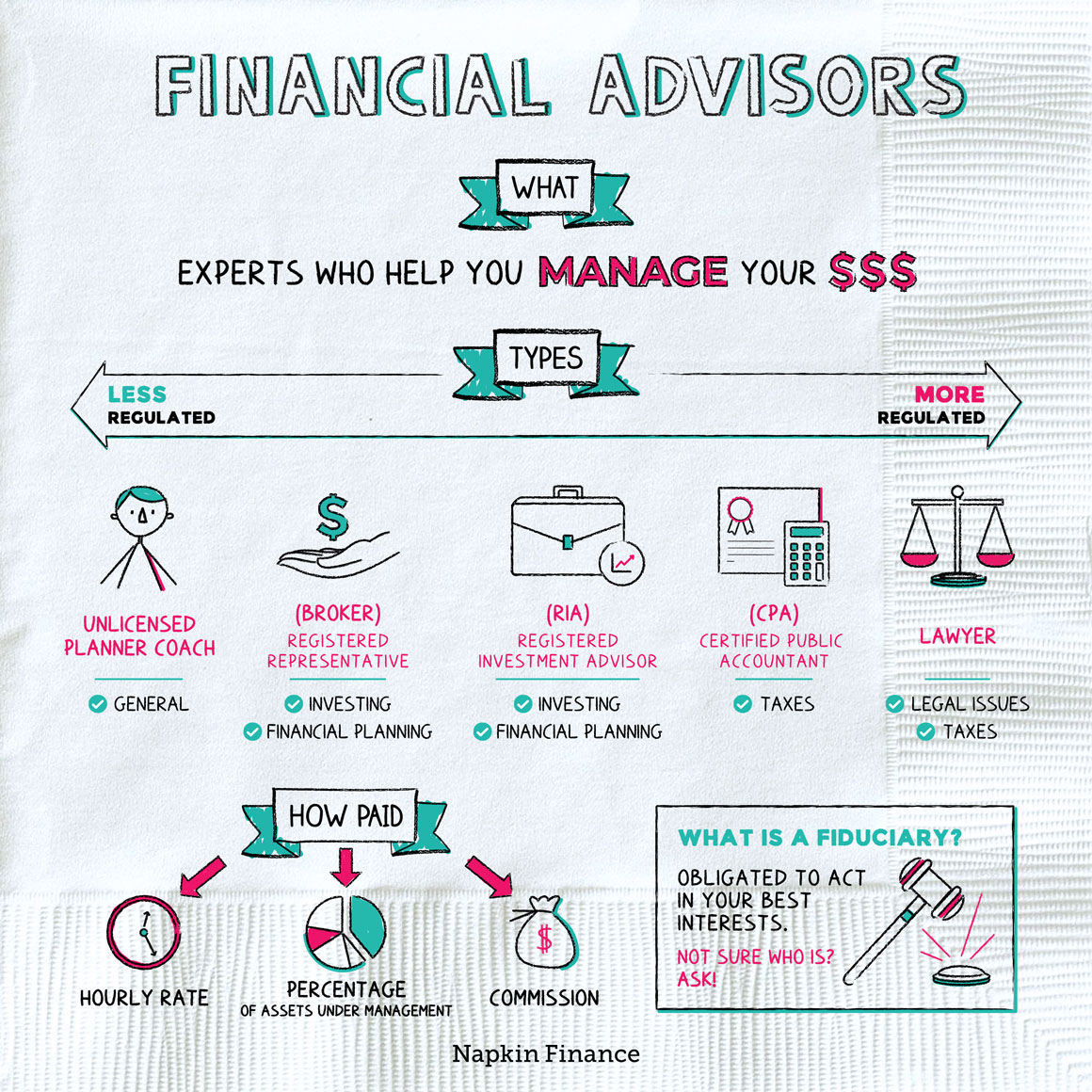

Heath can be an advice-only planner, which means that he does not handle their customers’ money immediately, nor really does the guy promote all of them certain financial products. Heath claims the appeal of this method to him is that he does not feel bound to offer a certain item to solve a client’s cash dilemmas. If an advisor is only geared up to offer an insurance-based means to fix problematic, they might find yourself steering some body down an unproductive path into the name of striking revenue quotas, according to him.“Most monetary services folks in Canada, because they’re settled according to the services and products they offer market, they may be able have motivations to advise one course of action over the other,” he says.“I’ve picked this program of motion because I am able to seem my clients in their eyes and not feel just like I’m benefiting from them at all or trying to make a sales pitch.” Story goes on below ad FCAC notes how you pay the specialist will depend on the service they offer.

Not known Facts About Investment Representative

Heath with his ilk tend to be paid on a fee-only product, which means that they’re paid like a lawyer can be on a session-by-session foundation or a hourly assessment price (financial advisor victoria bc). With regards to the range of services and also the expertise or typical clients of your own expert or coordinator, per hour charges can range within the hundreds or thousands, Heath saysThis is as high as $250,000 and above, he says, which boxes on the majority of Canadian homes with this degree of service. Tale goes on below ad for anyone not able to pay charges for advice-based strategies, and also for those not willing to quit part regarding investment comes back or without adequate cash to get started with an advisor, there are several cheaper and even complimentary options to take into account.

How Investment Consultant can Save You Time, Stress, and Money.

Story continues below ad Finding the right economic planner is a little like matchmaking, Heath states: You want to find some one who’s reputable, features an individuality match and is also the best person your period of life you’re in (https://sketchfab.com/lighthousewm). Some favor their particular experts as more mature with considerably more experience, he says, although some favor someone younger who is able to ideally stick with them from very early decades through retirement

Retirement Planning Canada Fundamentals Explained

One of the primary errors someone could make in choosing a consultant isn't asking enough questions, Heath says. He’s amazed when he hears from clients that they’re nervous about asking questions and possibly being foolish a trend he discovers is as normal with established experts and the elderly.“I’m shocked, given that it’s their cash and they’re spending a lot of costs to those individuals,” according to him.“You need to have the questions you have answered and also you have earned to own an open and truthful commitment.” 6:11 Investment planning all Heath’s final advice applies whether you’re shopping for external financial support or you’re going it alone: educate yourself.Listed below are four facts to consider and have yourself whenever finding out whether you should touch the expertise of a financial specialist. The net really worth isn't your revenue, but alternatively a sum which will help you understand exactly what cash you get, how much you save, and the place you spend cash, as well.

Our Independent Financial Advisor Canada PDFs

Your child is on the way. The breakup is actually pending. You’re approaching pension. These and various other significant existence activities may remind the requirement to visit with a monetary consultant about your visit this site right here investments, your financial targets, and other monetary matters. Let’s say the mom kept you a tidy amount of cash in her might.

You have sketched your own financial strategy, but have a hard time staying with it. A financial expert may offer the accountability that you need to place your financial anticipate track. Additionally they may advise tips modify your monetary plan - https://www.anyflip.com/homepage/megji to be able to maximize the possibility outcomes

The Independent Financial Advisor Canada Statements

Anyone can say they’re a financial consultant, but a consultant with expert designations is actually preferably the main one you should hire. In 2021, approximately 330,300 Americans worked as individual monetary advisors, based on the U.S. Bureau of work studies (BLS). Many financial experts tend to be self-employed, the bureau claims - independent financial advisor canada. Typically, you can find five types of monetary experts

Brokers usually make earnings on positions they generate. Agents are managed by the U.S. Securities and Exchange Commission (SEC), the Investment business Regulatory Authority (FINRA) and state securities regulators. A registered investment specialist, either someone or a strong, is a lot like a registered agent. Both buy and sell opportunities on the part of their customers.

Report this wiki page